Proof of work (PoW) is a technology that helps to prevent fraudulent transactions from taking place. This, in turn, supports the use of cryptocurrencies.

Some popular proof-of-work cryptocurrencies that use mining to reward users for validating activity on a blockchain network include Bitcoin, Litecoin and Dogecoin.

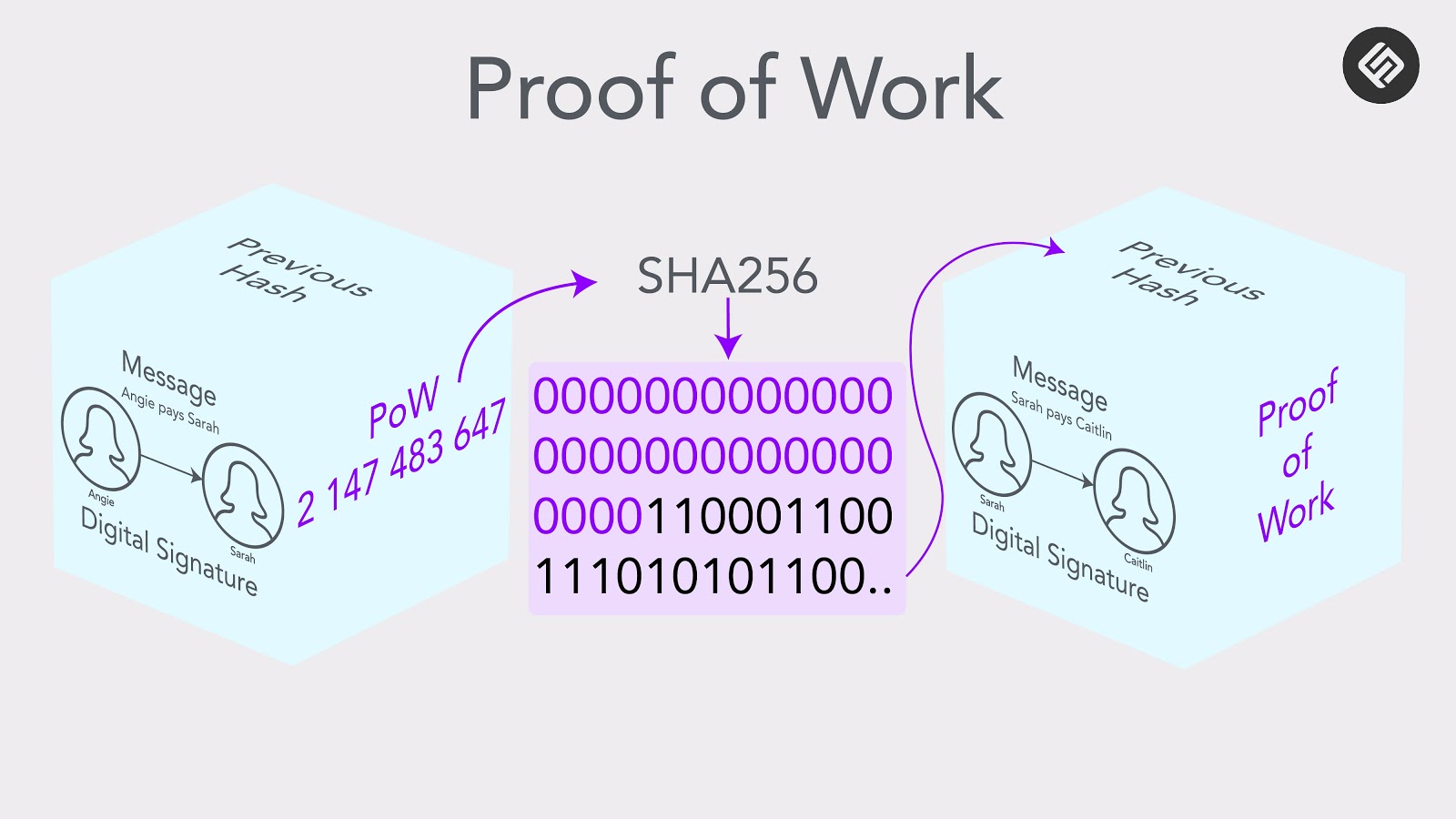

In order to add a new block of transactions, miners first have to complete a series of difficult cryptographic operations. This is known as “proof of work.” By doing this, it becomes much more costly to attempt fraud.

The mining process can be very energy intensive, which has fueled environmental critiques of cryptocurrency. Ethereum, the second-most valuable cryptocurrency, switched to a more efficient system called proof of stake in September 2022, and many newer crypto projects are also looking beyond proof of work.

Even so, the proof-of-work system is still an essential element in cryptocurrency. For instance, Bitcoin mining is how new Bitcoins are formed and it currently dominates the market. Furthermore, crypto mining could be worth billions of dollars based on certain estimates.

Bitcoin and other cryptocurrency platforms are created to do peer-to-peer transactions between random individuals. This would be simple if there was a dependable central authority, like a bank, keeping track of who owes what to whom. However, cryptocurrencies differ from regular currency because they’re supposed to be decentralized with no one group in charge. They should also function without the need for faith.

The proof of work is a known consensus mechanism that allows cryptocurrencies to exist both independently and securely. When any user attempts to update the ledger of shared transactions, there is always the potential for fraud or human error. Cryptocurrencies need systems in place to prevent these mistakes from happening.

In general, reward systems like proof of work make it more financially beneficial to be truthful rather than deceitful. To illustrate, let’s use Bitcoin.

In essence, having one Bitcoin in your digital wallet means that there is a global consensus amongst users about the balance of transactions in your account.

But what if someone wants to submit a fraudulent transaction after they had already paid you in Bitcoin? To prevent this, miners check every new transaction against the historical record. This process is called verification, and it’s vital to ensuring that each transaction adds up. Miners have a financial incentive to verifying transactions because they get rewarded for their efforts with cryptocurrency.

A miner who’s able to submit a block has spent a lot of money on machinery and electricity with the hopes of gaining mining rewards. If other users don’t accept the submission, they miss out on potential earnings.

In order to mine cryptocurrency, one must be a part of the proof-of-work system. If successful, miners are then rewarded with newly created cryptocurrency. By doing this, it helps to keep the underlying network running smoothly.

Cryptocurrency miners search for recent transaction data and compile it into a “block” that can be added to a protected, permanent record. In order for the network to approve the block, however, miners must first solve an intensely difficult math problem.

With most valuable cryptocurrencies, like Bitcoin, the reward for “mining” by solving complex puzzles can be worth a lot of money. Because the competition to solve these puzzles is so tough, miners usually use computers that are very expensive and built only for mining. Your laptop wouldn’t have a chance against those rigs.

An alternative to proof of work is called proof of stake, which uses a different method to achieve consensus known as staking.

People who own cryptocurrency validated through proof-of-stake can use their tokens to submit blocks of transactions or delegate that power to someone else. In order to propose a block, you haveskin in the game, so to speak.

As with proof-of-work cryptocurrencies, reward systems exist for successfully submitting blocks of information in a proof-of stake system. What’s more, both types of systems provide motivation to avoid fraud or mistakes: if you submit inaccurate data, you might lose some of the cryptocurrency that was at stake.

The PoW mining system is a critical element in the world of cryptocurrency. Bitcoin was the coin that popularized this method, and many other coins – called altcoins – followed suit.

However, proof-of-stake cryptocurrencies are on the rise in popularity. They don’t require as much computing power and energy to maintain, which makes them more environmentally friendly than other options. Also, you don’t need specialized equipment or knowledge to participate in staking like you do with mining–anyone can do it!

Consensus mechanisms like proof of burn protect against Sybil attacks by requiring a user to destroy some amount of cryptocurrency to propose a new block.

In other words, cryptocurrencies with a proof-of-work system have more data to support them and therefore are more reliable. However, there is more to consider than just the currency’s confirmation process when thinking about investing.

When you’re thinking about investing in any digital asset, one of the most crucial questions to ask is what gives it value? Make sure to consider what the purpose of the asset is, whether it meets that purpose well, and if there are any competitors who might do a better job—regardless of their consensus mechanism.

Conclusion

- Proof of work (PoW) is a technology that supports cryptocurrencies by preventing users from carrying out fraudulent transactions.

- PoW requires miners to collect cryptocurrency transaction data and append it to historical records.

- The mining process can be energy intensive, which has fueled environmental critiques of cryptocurrency.

- Proof of work is known as a consensus mechanism, designed to enable cryptocurrencies to be both “trustless” and decentralized.

- Mining rewards successful miners with newly created cryptocurrency, keeping the underlying network up and running.